Lot of people confuse between health insurance and mediclaim and when the need arises, are shocked when their claims are not entertained or have a difficult time to figure out what to do when there is a requirement. While mediclaim is a form of health insurance, it is not enough with mediclaim alone to cover several illness and health conditions in todays modern world.

What is Mediclaim?

Mediclaim Insurance is a Health cover which takes care of medical expenses following Hospitalization/Domiciliary Hospitalization of the Insured in respect of the following situations:

- In case of a sudden illness

- In case of an accident

- In case of any surgery which is required in respect of any disease which has arisen during the policy period.

The main feature of mediclaim is to provide cover for hospitalization and treatment towards accident and pre-specified illnesses for a specific sum assured limit. The mediclaim premium is based on the sum assured.

The amount paid towards mediclaim premium for self/spouse/children provides tax exemption under section 80D for a maximum of Rs 15,000 with another Rs 15,000 benefit on mediclaim premium for parents (Rs 20,000 if parents are senior citizens). Although, not advisable, mediclaim must not be taken for the tax benefit, else it degenerates into a tax saving instrument, rather than a lifeline for yourself and your family.

Covered Risks:

Typically Health cover is a hospitalization cover and reimburse the medical expenses incurred in respect of covered disease /surgery while the insured was admitted in the hospital as an in patient. The cover also extends to pre- hospitalzation and post- hospitalization for periods of 30 days and 60 days respectively

Major Exclusions:

Any pre-existing disease, any expense incurred during first 30 days of cover except injury due to accident, all expenses incurred in respect of any treatment relating to pregnancy and child birth. Treatment for Cataracts, Benign prostatic hypertrophy,Hysterectomy, Menorrhagia or Fibromyoma, Hernia,Fitula of anus,Piles, Sinusitis, Asthma,Bronchitis, All Psychiatric or Psychosomatic disorders are excluded from the scope of the cover.

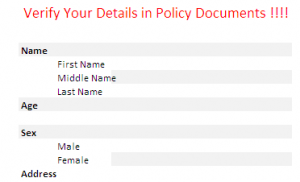

Before you purchase any instrument, it would be wise to review the fine print and validate if the policy meets your requirements.

What is Health Insurance?

Health insurance, particularly the ones launched by life insurance companies, can be a lot more broad-based than mediclaim.

Some features of health insurance plans include:

- Comprehensive health cover against critical Illnesses –as many as 30 illnesses in certain plans

- Discount on premium if sum assured exceeds a particular limit like Rs 10 lakhs for instance

- Flexibility to reduce premium after a specified period

- Flexibility to reduce sum assured after a specified period

- Flexibility to reduce policy term after a specified period

- Health insurance premium provide tax exemption under section 80D of Income Tax Act 1961, this being one of the few meeting points between health insurance and mediclaim

Evidently health insurance plans are superior to mediclaim in terms of breadth of diseases and illnesses covered, quantum of sum assured and flexibility. While mediclaim may prove adequate up to a point, it is health insurance that can be expected to bail you out from a serious & expensive medical condition.

Related Posts:

The new Health Companion Health Insurance Plan offers an array of customer centric features like no capping/sublimit of any sort on hospital accommodation, coverage for 19 relationships under a single policy (including spouse, parents, grandparents, children, in laws, nephew and niece), unique refill benefit to replenish 100% sum insured in the same policy year even though the entire base sum insured has not been exhausted, 20% enhancement in sum insured for every claim free year as No Claim Bonus, coverage of all medical expenses incurred 30 days prior to hospitalization and 60 days post hospitalization, option to top up existing coverage and no co-payment at any age, among many others.

The new Health Companion Health Insurance Plan offers an array of customer centric features like no capping/sublimit of any sort on hospital accommodation, coverage for 19 relationships under a single policy (including spouse, parents, grandparents, children, in laws, nephew and niece), unique refill benefit to replenish 100% sum insured in the same policy year even though the entire base sum insured has not been exhausted, 20% enhancement in sum insured for every claim free year as No Claim Bonus, coverage of all medical expenses incurred 30 days prior to hospitalization and 60 days post hospitalization, option to top up existing coverage and no co-payment at any age, among many others.